With increased competition and decreased government subsidies, energy system manufacturers and project developers are living with increased pressure on operating margins. There is an old adage that says “you can’t manage (or fix) what you can’t measure.” Modeling provides an opportunity to “measure” the results of changes before incurring the cost of those changes. The alternative is to make the changes and hope the outcome is as expected. Modeling is a forward-looking (predictive) measurement tool versus the alternative of a retrospective review.

For the energy industry, modeling solutions already exist; it is just a matter of management empowering its staff to use these tools to make better business decisions. Modeling provides a “translation” of technical decisions (energy production, degradation, labor) into business results (cost, margin, profit).

The models available today fall into three broad categories, cost of ownership (COO), factory level modeling, and levelized cost of energy (LCOE). The first two are focused on system component manufacturing and assembly and are used by both manufacturers and their suppliers. LCOE is focused on project development but is impacted by the products produced by component manufacturers. Which model to use is based on what questions need to be answered. Selecting the right model and modeling methodology is the first step in the successful implementation of this business improvement process.

The retail cost of conventional electricity is rising while the cost of renewable electricity is dropping, so wide-scale grid parity is likely at some point in the future. There are numerous groups of stakeholders interested in tracking these developments, with quantitative accuracy carrying enormous value. Investors need to know their expected return on investment, regulators and policy makers help define the economics of energy production and require reliable information, funding agents need a means to analyze proposed technology development, and technology developers want to understand how they will compete relative to other technologies. One needs a method to fairly compare energy costs produced by different means, and LCOE is intended to be just this.

LCOE can be thought of as the price at which energy must be sold to break even over the lifetime of the technology. It yields a net present value in terms of, for example, cents per kilowatt-hour. This is an assessment of the economic lifetime energy cost and lifetime energy production and can be applied to essentially any energy technology. For computing the financial costs the equations can be embellished to take into account not only system costs, but also factors such as financing, insurance, maintenance, and different types of depreciation schedules.

Given that LCOE was originally designed as a breakeven model, it has limited application to situations where the project owner is interested in revenue (profit) generation or in installations where the electricity produced is displacing some or all of the high cost tier grid supply. For these applications, a new model has been developed called Total Cost of Ownership for Energy™ (TCOe™). TCOe™ includes additional factors such as revenue/displacement and cost factors applicable to both rooftop and utility scale applications.

By its nature, LCOE is limited in the breadth of questions it can answer and boils down to simply which energy producing project will generate the lowest kilowatt-hour cost in today’s dollars? TCOe™ attempts to remove some of the limitations of LCOE with regard to revenue generation, the value of grid power displaced, and the value of power density when faced with space constraints inherent in rooftop installations.

TCOe™ is built on a relational database engine with a graphical user interface. The software runs on Windows 7 or later and is compatible with both 32bit and 64bit operating systems.

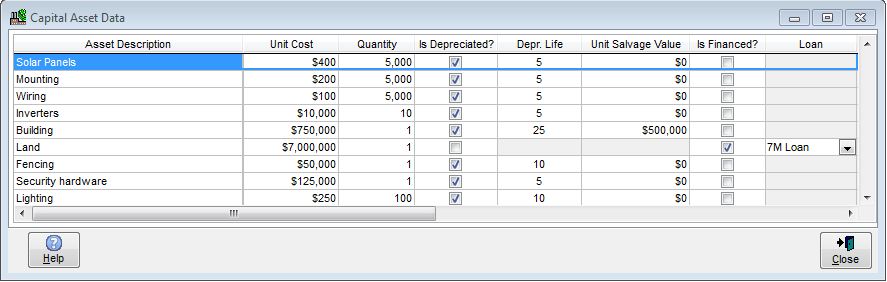

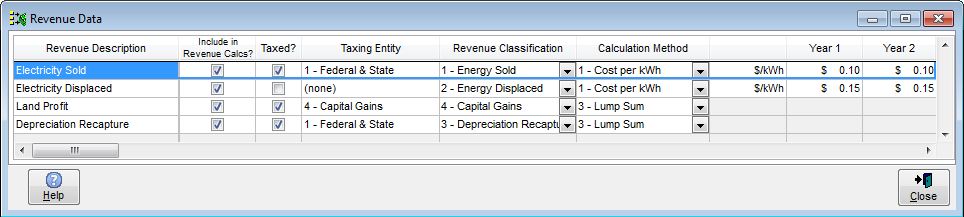

Data entry is divided into ten forms: general information, tax credits, loans, decommissioning, overhead, revenue, capital assets, installation labor, operations labor, and operating expenses. These forms are accessed through an input menu, navigation bar, or button bar.

Input Screen – Capital Assets

Advanced Input – Revenue by Category

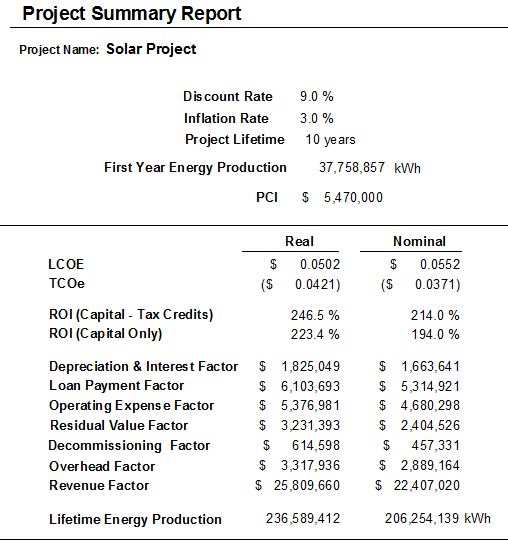

TCOe™ provides outputs consisting of a project summary report, income statement, and cash flow statement. The project summary report provides a review of the important project results including information on LCOE, TCOe™, return on investment (ROI), and the individual factors that are subsets of LCOE and/or TCOe™. The income statement shows the revenue, expenses, and taxes for each year of the project. The cash flow statement shows the sources of cash and cash uses for each year of the project.

Reporting – Project Summary

TCOe™ is a must have for every organization involved in energy production; from suppliers of equipment and materials to project developers. TCOe™ provides all participants a predictive view of their impact on the project and, ultimately, if the project will be a financial success.

Call today for more information from Wright Williams & Kelly, Inc. Providing software solutions for productivity measurement and enhancement since 1991.